The conforming loan limits were recently announced and in our area the max conforming loan limit for one unit was raised to $970,800. For details we would highly recommend talking with your bank’s mortgage department or a lender. Take a look below for more information.

High-Cost Area Limits

For areas in which 115 percent of the local median home value exceeds the baseline conforming loan limit (Los Angeles County fits into this criteria) , the applicable loan limit will be higher than the baseline loan limit. HERA establishes the high-cost area limit in those areas as a multiple of the area median home value, while setting a “ceiling” at 150 percent of the baseline limit. Median home values generally increased in high-cost areas in 2021, which increased their CLL. The new ceiling loan limit for one-unit properties will be $970,800, which is 150 percent of $647,200.

For Los Angeles County the numbers are

|

One-Unit Limit

|

Two-Unit Limit

|

Three-Unit Limit

|

Foour-Unit Limit

|

|

|

Los Angeles County

|

$970,800

|

$1,243,050

|

$1,502,475

|

$1,867,275

|

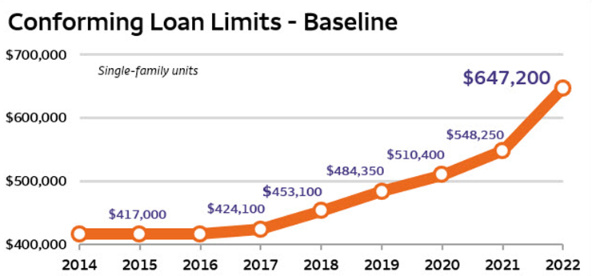

National Baseline

The Housing and Economic Recovery Act (HERA) requires that the baseline CLL for the Enterprises be adjusted each year to reflect the change in the average U.S. home price. Earlier today, FHFA published its third quarter 2021 FHFA House Price Index® (FHFA HPI®) report, which includes statistics for the increase in the average U.S. home value over the last four quarters. According to the nominal, seasonally adjusted, expanded-data FHFA HPI, house prices increased 18.05 percent, on average, between the third quarters of 2020 and 2021. Therefore, the baseline CLL in 2022 will increase by the same percentage.